The next domestic crisis

They are called federally insured student loans.

American students qualify for federal government insured (taxpayer backed) loans, but only if the students are breathing.

The banks hand out the money, and the taxpayers guarantee repayment, at high interest rates paid to the banks.

The banks love these loans as they are guaranteed by you. That’s why they make them.

I wrote about this before when I was running for Congress. You can read it here. The total student loan debt is now well over a trillion dollars, or 1.2 million million dollars and rising! Fast.

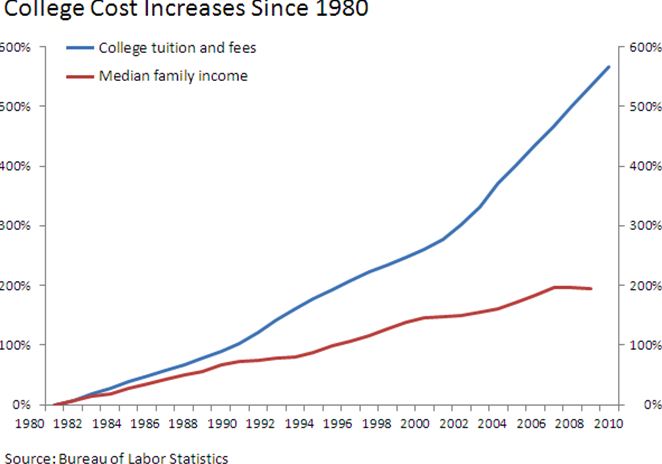

That’s why college costs are skyrocketing. The colleges can charge whatever they want for tuition, plus, plus plus.

As most students just sign a piece of paper without any credit qualification requirements, the actual education costs are theoretical.

When it becomes reality, the students have graduated and are buried in debt. It’s called live now, pay later.

This crisis is waiting in the wings to bite us all. When our US dollar collapses within a few years, it will be cited as one of the reasons. That dollar collapse will make our last seven year “Great Recession” seem like the golden years.

If you look carefully at the chart you’ll see that the over forty, fifty and sixty year old groups debt levels keep increasing! That’s because these groups can’t pay them off fast enough. The interest keeps adding to the principal owed and the aggregate debts increase.

There are over 43,000,000 borrowers with outstanding federally insured student loans. Seven hundred and seventy nine thousand people, owe more than $150,000 and three hundred and forty six thousand Americans owe more than $200,000! That’s a huge amount, but the majority owe the banks less!

Federally insured student loan interest income is a guaranteed windfall for the banks. Banks borrow money from the Federal Reserve at very low rates, currently 1/2%. The difference between what they borrow the money for and what they lend it out at is called the “spread.” That spread is guaranteed. Check the graph below to see how much easy money the banks are making!

It’s at least 6% today! Without using complex calculations, that’s about $60 billion a year of pure profit. That’s sixty thousand million dollars without any risk. Nice… for the banks.

One of the reasons to study to be an M.D. is that different government agencies will, essentially, pay off the M.D.s loans if they participate in a government medical practice program.

For example, a newly minted MD joins the Army as an officer. In just a matter of two years or so, the Army (the taxpayers) will pay off the typical $176,000 in student loans plus the Army doctor will receive a decent salary with lots of benefits. All at taxpayer expense. The doctor then goes into private practice and makes lots of money after the taxpayers paid for his or her education.

You may not think about this crisis waiting in the wings but here’s an example. The New York Times reported that a woman (not an M.D.), Liz Kelley, a Missouri high school teacher owes nearly one half million dollars in student debt and is a poster child for higher education loans gone mad!

The New York Times article is about how this lady started her life of student debt in 1994 when she borrowed $26,278 ($42,000, inflation adjusted) to get a degree. She borrowed another $37,000 to go to law school, became ill but still owed the money.

She then got a teaching job, but needed a graduate education to advance her career in education. So what did she do?

So she borrowed even more money to pay for it, and the legally allowed living expenses including helping support her four children. That was another $60,700 of borrowed taxpayer insured money.

That wasn’t so bad, but the deferred payments and high interest rates pushed the total amount owed to $194,603 in 2005.

She then borrowed even more money to help pay for the education of her children and the debt kept piling up. So at forty eight, she cannot defer the repayments any longer, and has a $410,000 debt to repay at a high interest rate. Good luck with that.

As all of these loans are federally insured, borrowed from banks where the taxpayers are ultimately required to make good, the chances are that they’ll never be repaid by Ms. Kelley.

I believe that our government will probably waive them (meaning the taxpayers will pay the banks off) due to hardship; the real reason to buy votes from the debt ridden student population. Our government likes to relieve debt as it buys gratitude and votes. And what’s another trillion dollars added to the national debt?

I posit that it will be a Democratic presidential solicitation for votes that will include waiving the debt.

If you don’t owe any money, you probably won’t notice the offer in a stump speech. If you owe lots you will. It’s a great way to buy votes.

Sad.