The tender trap

I heard a report recently that U.K. payday lenders were making significant profits from penalty charges associated with customer loans. When I stopped at my bank in Marietta to deposit some checks I had a discussion with the head teller about our banks providing something similar… zero interest loans. She admitted that this was big business, and very profitable for banks. Here’s how it works. I call it the tender trap.

First, the banks send millions of solicitations to customers and prospects otherwise known as the 99%. They offer very cheap “consolidation” loans where the interest rate is either zero or a very low rate, determined by the credit score of the prospect, usually 1.99% – 7.99%. That’s actually 2-8%, but people don’t see the .99 but visualize as 1% and 7%, similar to gas pump pricing. This promotional interest expires, but the prospect doesn’t focus on that, just the “deal” entering the agreement.

That’s the tease. Usually, there is a fee based on the principal borrowed. That fee covers the complete cost to the banks for them to borrow the money from the Federal Reserve, 0.75% at the moment. The bank’s cost for this transaction is zero or less, as they charge a fee to borrow the money, usually 1-4% of the amount borrowed. It more than covers their costs. It’s called borrow low, and loan high.

Once the banks have loaned the customer the money, they wait. When and if you –

a) Are late

b) Don’t make the full minimum payment

c) Make the payments but don’t pay off the principal when the “deal” expires (the most common result)

… they have accomplished the bank’s real goal, locking you into a long period of payments at 12-25% to pay both penalties and very high interest rates compared to the bank’s almost no cost of borrowing the money to lend to you.

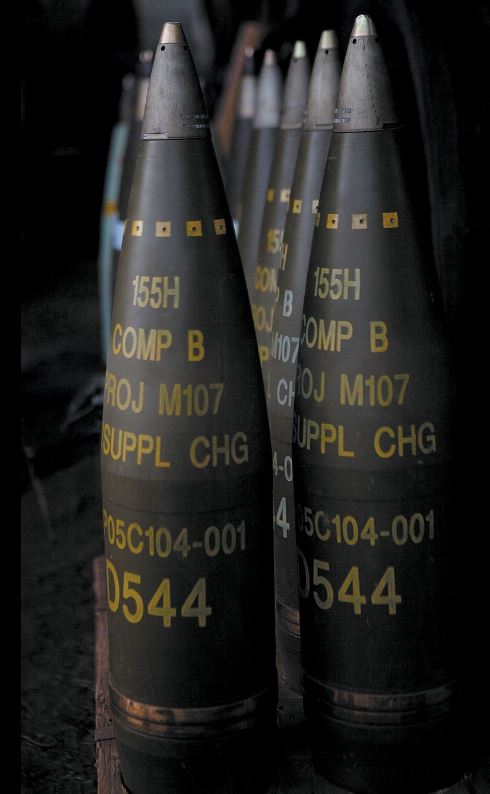

It’s like getting a donkey to move in the desired direction, by holding a carrot on a stick in front of its nose. After a while, banks apply a stick.

If elected, would I block this type of transaction? I don’t think so, as many people get these deals, make timely payments and pay them off before the promotion expires thus getting a “free ride.” I posit that the vast majority get caught in the tender trap. A trap that’s very easy to enter, but very difficult to get out of. Keep rowing.

I would look at this very carefully and, perhaps, increase the required documentation so that the 99% really understand what they are getting into. It probably won’t make a difference, but full disclosure is important so that the 99% can’t complain about being trapped without full knowledge of what they got themselves into.

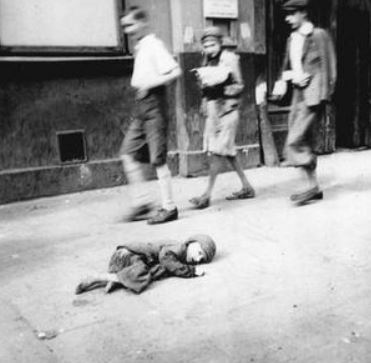

This is what the banks (and our government) thinks of you. It has to change.

Caveat emptor.