The Euro mess deepens

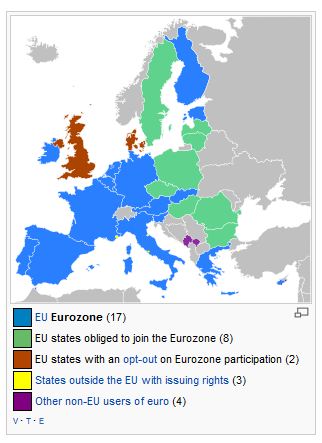

It is really great to put your head in the sand, like the ostrich, and hope that no one notices that the rest of your body is still sticking out. That’s the Eurozone, a collection of 17 European countries with a shared Euro (€) currency.

The problem was that weak countries were allowed in years ago to build the Eurozone quickly. It’s coming back to bite. It wasn’t that it was a big surprise, but the Eurozone organizers turned a blind eye to the weak governments application documents that were full of lies as to the weak finances. All they had to do was look at how many times they had devalued their currencies… that’s the tell. They didn’t.

Of these 17 countries, Germany is the strongest and Greece the weakest. Across the entire zone, unemployment is up to 11.7% and climbing. In Spain, a full 50% of people under 25 are unemployed; in Greece, the general unemployment rate is over 25%. Rioting and marches against cutbacks are common. It’s the new normal.

Is it any wonder that the financially strong Switzerland, the haven for huge fortunes (that’s the grey blob in the middle of the graphic) still uses its own Swiss Franc as currency, having declined to convert to Euros like the weak countries did? For the record, the other bastion of wealth, Liechtenstein, next door to Switzerland, rejected the Euro as well in favor of using Swiss Francs instead. A wise choice.

Yet, in spite of the encroaching disaster any positive news whatsoever is greeted by traders with cross-fingered joy, increasing the Euro to $1.30 today. I’m surprised that the traders are so hungry for good news, that anything… anything pushes the value up. At least for now.

That’s good for the dollar short term, as our currency looks relatively strong. But that strength is relative. It’s like saying who is the strongest man in a group of 80-90 year olds? Yes you can find that one strongest person, but not compared to anyone in their 30’s.

The real problem is that we sell a lot of stuff to Europe. With the massive number of unemployed people and shrinking economies, they aren’t going to be buying much “Made in the USA” stuff, so our economy will slide with theirs!

It’s going to be an interesting four years until we get our next “save the country” president.