The race to the bottom

Japan has a moribund economy. It’s had one for decades. A twenty year slump. Nothing much is happening in Japan as they don’t have significant inflation. Why does that hurt the Japanese economy? If you live in Japan and want to buy something that either doesn’t increase in price due to inflation, or actually drops what’s the hurry?

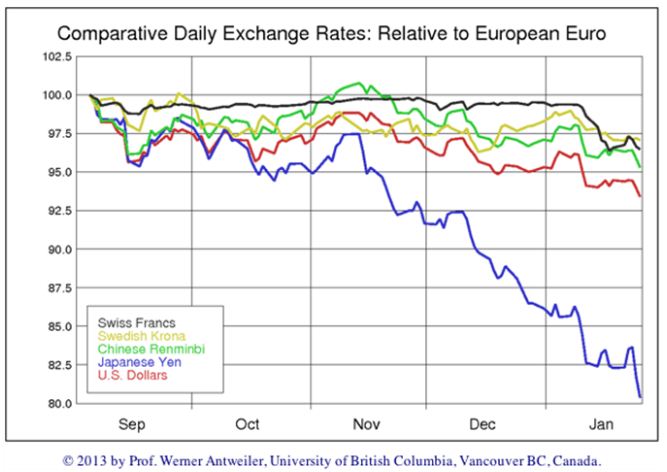

So Japan is now pumping money into its economy, and devaluing the Yen in an effort to lower the cost of its exports. When the Yen drops in value compared to the dollar, its exports drop in price as paid by other countries.

The problem is that Japan is a G8 member, as one of the world’s largest economies using that group name. They G8 members all agreed to keep their currencies stable to avoid the devaluation game. The Yen is also paired with the Euro, so while the European economy is in shambles, so that the Euro should be dropping in value, it is actually going up. When the Yen starts increasing in value again, the Euro will should drop back down as it’s wildly overvalued. I gave up currency trading twenty years ago.

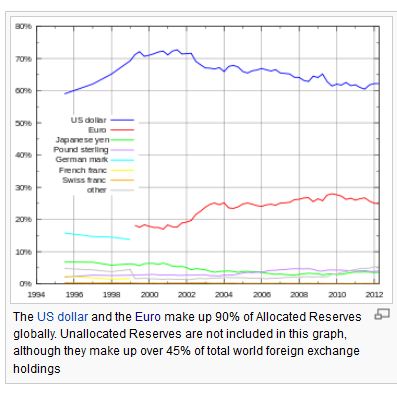

The Yen devaluation will drive foreign demand and if they are lucky, economic activity in Japan will pick up. Unfortunately for Japan, they must buy oil using U.S. dollars, the main international reserve currency. So it will take more Yen to buy dollars to pay its international bills. That increases the Japanese cost of living and the prices of raw materials, all priced in dollars, but for a while everything will look good. For a while.

Other countries will also devalue their own currency in an effort to block any increase in Japanese imports. So it becomes a race… to the bottom. The other countries will reduce their own currency value to seek parity, that is limiting the effect of the Yen devaluation. They will all suffer the cost of oil, the fundamental commodity of all of the industrialized countries.

China is resisting the United States government trying to hold down its currency, or everything you buy at Wal Mart will go up in price; you’ll buy less and China’s exports will drop, hurting China. So they resist.

We are the only country that can devalue its currency and get away with it. Why? Oil is priced in dollars so our cost of importing oil won’t change. That’s because the U.S. dollar is the world’s dominant reserve currency. For now.

If that changes, we are in trouble. If we continue our reckless spending, we’ll lose it and we will be in trouble. Great Britain’s Pound Sterling was the world’s currency until it was nearly bankrupted during the Second World War, and our government wrestled the reserve currency status away at the Bretton Woods conference in 1944.

It can happen again. If we don’t stop our reckless spending, it almost certainly will.