The next European country ready to fail

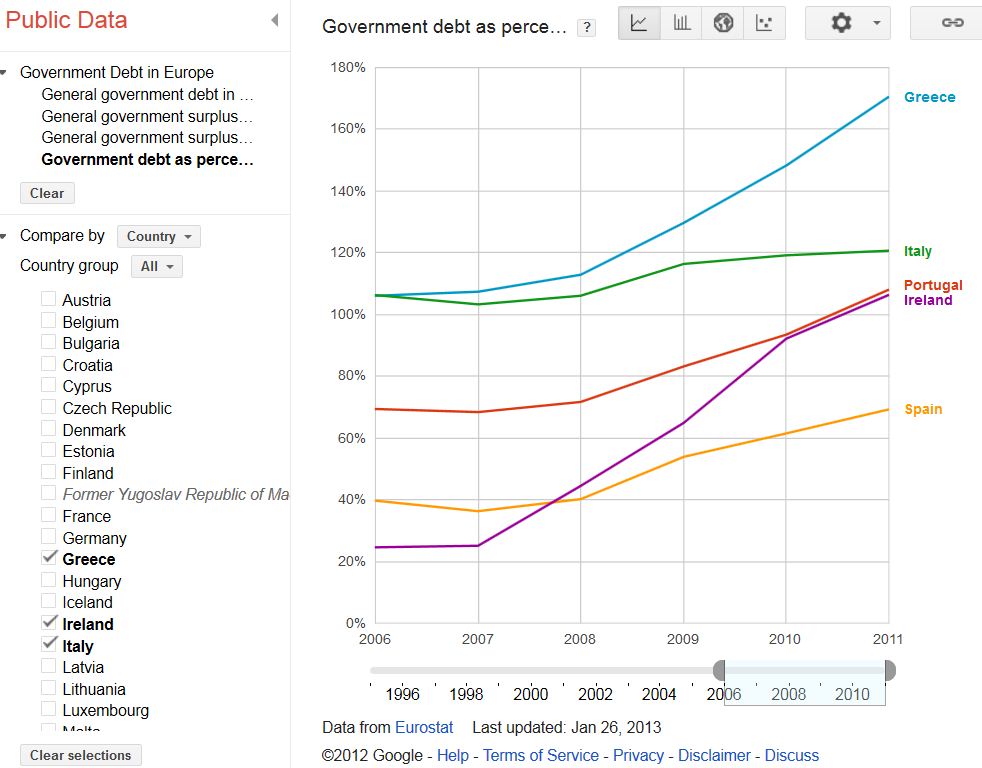

As you may know, the PIGS of Europe continue to teeter on the edge. The PIGS, as they are known, are the economies of Portugal, Ireland, Greece and Spain.

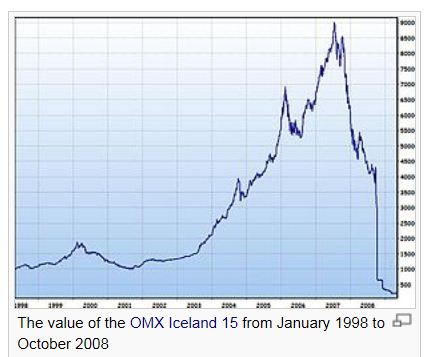

Although Iceland, a country that was in the same trouble as the PIGS, managed to survive with a massive (35%) devaluation of their currency against the Euro. The PIGS can’t use that standard tactic as they all use the same currency.

The Icelandic stock market also collapsed, and if our government keeps spending borrowed money, this could be the S&P 500 in the future. Some brave people may become very rich if they buy at the bottom of our next crash. Most people will be buying tents. Our crash of 1987 will seem like a speed bump. The PIGS are all in the Eurozone, meaning that they all use the Euro and not individual currencies, so they can’t devalue their currency. That may be their downfall. Japan is devaluing its currency to help its economy at this time. That’s why the Yen is losing value. It’s a strategic devaluation.

The PIGS are all in the Eurozone, meaning that they all use the Euro and not individual currencies, so they can’t devalue their currency. That may be their downfall. Japan is devaluing its currency to help its economy at this time. That’s why the Yen is losing value. It’s a strategic devaluation.

Ignoring the tiny eurozone country of Slovenia teetering on the edge of failure, I recently found some disturbing statistics about Italy. Although Italy has an overall 11% unemployment rate, if under 25 it’s a staggering 36%! That level of unemployment invites civil unrest as is happening in Greece. Italy’s ratio of sovereign debt to GDP is the second highest only to Greece within the EU. Greece’s debt to GDP is 170%, Italy, 120% and ours, 109%. The EU average is 92%. At the other end of the spectrum, China has a 9% ratio.

What does that tell you? Western nations are spending far more than they take in. They do it to give voters everything they want using borrowed money. Eventually, the borrowing becomes unsustainable and a collapse occurs.

Unless we get our house in order fast, it will happen here.