The interest trap

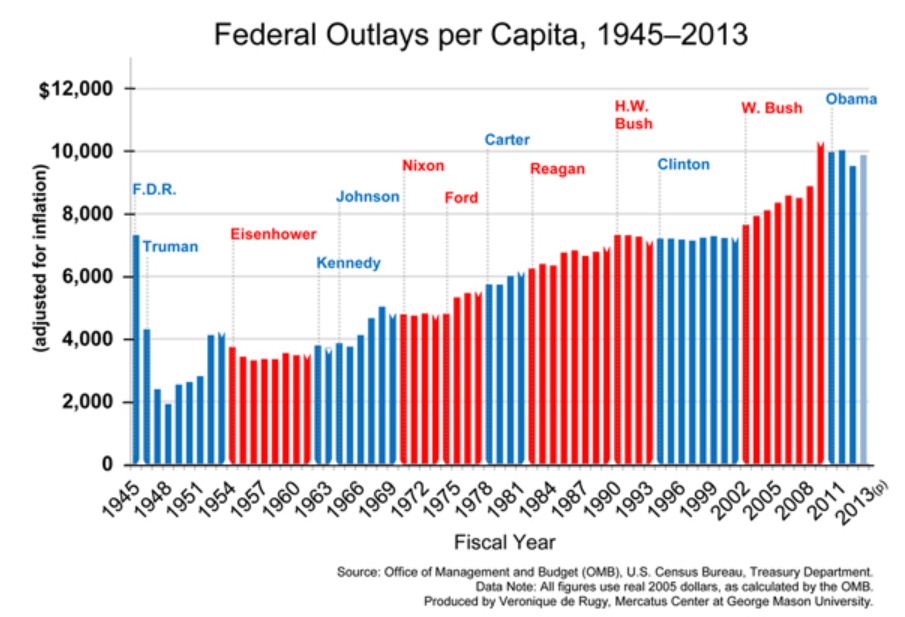

If you look at this Federal Outlays Per Capita chart, (how much money our government spends per person) illustrated in 2005 inflation adjusted dollars, you’ll see an obvious trend. It goes up and up and up. The federal government spends more and more money on its citizens. Why? To buy votes, and to create the illusion of perpetual prosperity.

Although it appears to be leveling off under President Obama, and even shrinking, the effects of the Obamacare and the soon-to-be next crisis in the series is not listed. That crisis will be interest rate increases, and likely followed by an epidemic of strategic student loan defaults. More on the student loan fiasco in another post.

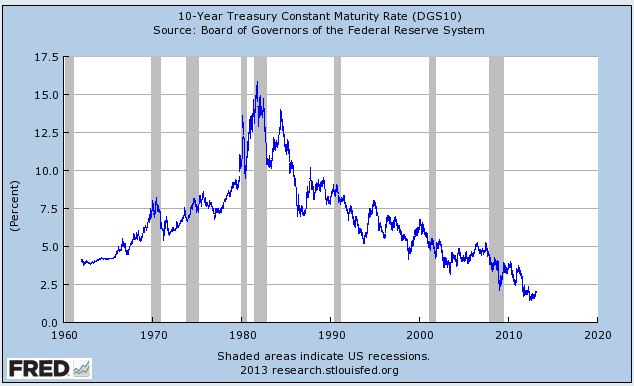

One of the intended consequences of flooding the country with cash during our recession is that interest rates were pushed down to extremely low levels. Those levels are unsustainable; when the demand for borrowing money increases, rates will increase.

And with the increase in rates, the cost of our national debt interest payments will soar.

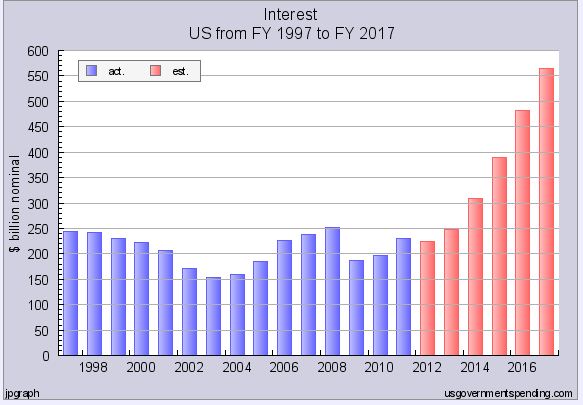

That $300 billion difference in yearly debt service payments, shown in the chart will have to come from “somewhere.” That’s nearly twice what our government collects in corporate taxes. That “somewhere” will be increased borrowing to pay the interest on our borrowed money. It’s a circular path to ruin.

If your household budget forced you to borrow money, just to make interest payments on your household debt then your family is in serious trouble. Our country is in serious trouble.

We’ve got to cut spending, increase productivity and cut corporate taxes to zero. That zero corporate tax rate, which only brings in about $180 billion a year, will make us the world’s largest tax haven. We’ll be deluged with foreign money and businesses coming here helping us get out of our spiral of increasing debt and perpetual financial crises.