How to decrease the national debt

Our national debt continues to spiral upwards. It’s how our government can lower taxes, fight very expensive never-ending wars (good news for the weapons manufacturers), and continue to pile on “free” services to ensure reelection.

As you know, although our Washington politicians complain about the national debt at election time, it’s a ploy to win again, again and again. And the public buys it. Over and over again, again and again.

As you also know, this is America and it’s all about money. That takes precedence over everything. Our federal politicians will disagree, but they lie, as telling the truth loses elections.

So here’s how to fix the problem, once and for all.

I want to tie federally elected and senior official’s federal pensions to the public debt. That puts their “skin in the game,” a way to stop them spending, spending, spending.

In simple terms, if the national debt increases by twenty percent while they are in office, their federal pensions are reduced by twenty percent. If our federal politicians do what they promise, and reduce the national debt, then their pensions increase by that amount.

In the time that it took you to read the prior sentence, our national debt increased by almost $400,000!

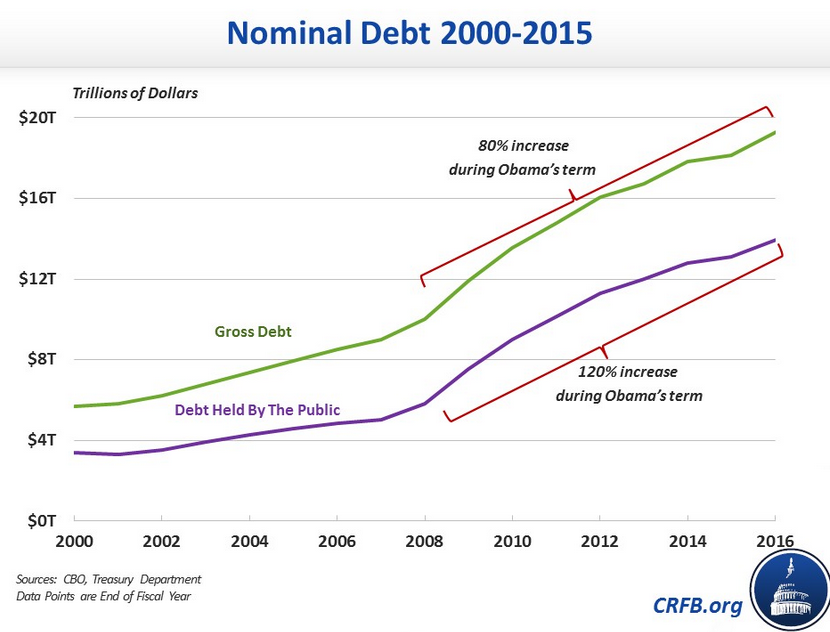

Under my simple plan, if a congressperson is in office from 2000 to 2016 and should retire with a federal pension of about $80,000 a year, that will be reduced to $25,000! Even the president is affected, as without any increase in the national debt after eight years of “service,” he (no she’s yet) currently receives a $205,700 a year pension! Using my linkage to the increase in the national debt, $64,000.

Do you think that this congressperson will vote for spending, when it hurts them in the wallet? Do you think that our president will sign a generous spending bill into law so easily? I think not.

I add in senior officials as they control budgets. Very big budgets.

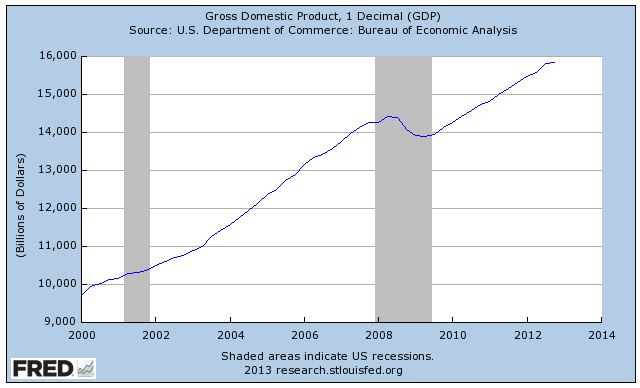

Here is a graph of our national debt compared to our GDP. It’s now similar to Greece’s ratios when their economy collapsed. Our situation if different, as we control the global money supply (at the moment), but the message is obvious.

If you want detail, read this.